Photo credit: www.theguardian.com

European shares bounce; dollar slides

European stock markets experienced a significant rebound at the opening, with major indices gaining over 2%.

In London, the FTSE 100 index surged by 130 points, or 1.6%, reaching 8,090. Meanwhile, markets in Germany, France, and Italy reported increases exceeding 2% during early trading.

The US dollar has weakened again, falling by 0.8% against a collection of major currencies. The British pound appreciated by 0.7% against the dollar, while the euro gained 0.55%.

Yields on eurozone government bonds rose, reversing a decline witnessed on Friday, following the news of exclusions for Chinese electronics from new US import tariffs, which alleviated concerns about US trade policy’s potential effects on the global economy.

Germany’s 10-year bond yield, considered the eurozone benchmark, increased by 4.5 basis points to reach 2.57%, recovering from a decline of 5.5 bps recorded on Friday.

Updated at 09.12 CEST

Key events

Please turn on JavaScript to use this feature

Charlotte Brumpton-Childs, a national officer with the GMB union, expressed confidence regarding the delivery of coking coal to the Scunthorpe steel plant, emphasizing that the necessary materials would be paid for and unloaded at Immingham Bulk Terminal within the next few days. This effort is crucial to prevent the permanent closure of the UK’s last major steel production facility.

In her remarks on BBC Breakfast, she stated:

I spoke with British Steel late yesterday and am quite reassured.

I’ve been informed that the coke at Immingham Bulk Terminal will be bought and unloaded shortly, and the government is actively working to secure additional raw materials currently in transit.

Following a one-day bill passed by Parliament on Saturday granting emergency powers, the government has taken steps to assume control of the Scunthorpe plant after Chinese owner Jingye rejected a £500 million support package aimed at keeping operations running temporarily.

A resolution regarding potential nationalization is expected within the next two weeks, contingent upon the plant’s ability to remain operational.

According to a spokesperson for the Chinese Embassy in London, as reported by The Times:

We are closely monitoring the situation at British Steel concerning the Chinese private company’s interests. We urge the British authorities to act fairly, impartially, and without discrimination, ensuring the protection of the rights and interests of the Chinese firm.

It is an objective reality that UK steel companies have been facing numerous challenges recently. We hope the British government will pursue negotiations with the relevant Chinese company to reach a mutually agreeable solution.

Reynolds: Officials on British Steel site ‘to keep jobs going and furnaces burning’

The Business Secretary, Jonathan Reynolds, has taken significant action by utilizing the government’s emergency powers to secure essential materials for British Steel, as confirmed by the business department.

The Chinese-owned company is urgently trying to acquire the materials necessary to keep its furnaces operational while the government works to avert the closure of the Scunthorpe facility, an uncontrolled cooling of which could make it prohibitively expensive to resume production.

Upon the enactment of the new legislation on Saturday, officials immediately went to the site and began collaborating with British Steel’s management to ensure timely payments for employees and suppliers.

Today, their focus is on acquiring local raw materials such as coking coal to maintain the operation of the blast furnaces. This is vital for the continued functionality of the plant, as failing to keep the furnaces heated could result in irreversible damage to the equipment.

A number of companies, including Tata and Rainham Steel, have extended their support to British Steel by providing managerial assistance and materials.

Reynolds commented:

When I say that steelmaking has a future in the UK, I genuinely mean it. That’s the reason we have enacted these new powers to preserve British Steel at Scunthorpe, and why my team is already engaged on-site to maintain jobs and furnace operations.

Steel is critical for our national security and our ambitious housing, infrastructure, and manufacturing initiatives. We will develop a long-term strategy for collaborative investment with the private sector to ensure a viable and sustainable future for the UK steel industry.

Matt Britzman, a senior equity analyst at Hargreaves Lansdown, noted:

Just when it appeared that the tariff situation couldn’t escalate further, tech investors have been immersed in a flurry of confusing and sometimes contradictory messages from the White House over the weekend. Despite the turmoil, European markets responded positively to developments regarding US tech components, resulting in a broad-based rally this morning, with the FTSE 100 rising by 1.5% in early trading.

This time, products like chips, smartphones, and other tech components have taken center stage. Initial indications from Friday night suggested the possibility of broad exemptions, but it later became clear that tariffs are still firmly in play. The unique development is that these products will avoid the harsh China-specific tariffs, and an existing 20% tariff will be applied for now as deliberations on these products continue.

This development is favorable for tech companies, particularly significant players like Apple, who could have faced a major upheaval in their pricing strategies under the proposed 145% tariffs. Instead, this reprieve allows Apple to bolster US inventory for current iPhone sales without immediate price increases. Strategic pricing decisions can be made aligned with the upcoming launch of its new handset in September, providing some breathing space amidst ongoing volatility.

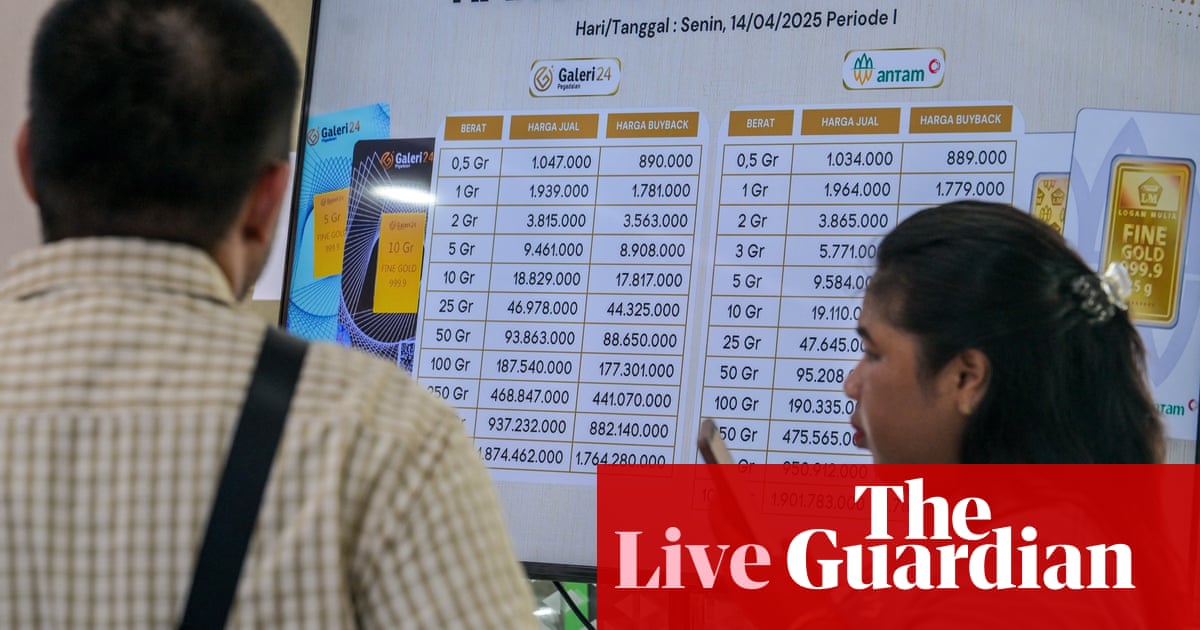

Gold has emerged as an attractive asset in the current climate, continuing its impressive upward trajectory this year, with only minor setbacks. Recent tariff developments have further enhanced its allure as a safe-haven investment, propelling prices to new all-time highs as investors seek shelter from the unpredictable political landscape.

Updated at 09.54 CEST

Chinese exports jump in March ahead of latest tariffs

China’s exports saw a notable increase last month as factories hurried to dispatch shipments before the implementation of new US tariffs, combined with the timing of the lunar new year holidays.

Exports surged by 12.4% year-on-year in March, reaching a five-month high, and exceeding economists’ expectations of a 4.4% increase. This increase follows a 3% drop in February. The rebound can be attributed to the lunar new year’s timing, which fell earlier this year in early February.

Despite this positive growth, economists caution that these figures are likely to be overshadowed by the escalating trade conflict between the US and China.

Julian Evans-Pritchard, head of China economics at Capital Economics, stated:

March saw export growth expedite as manufacturers aimed to deliver goods to the US ahead of ‘Liberation Day.’ However, we anticipate shipments will decline significantly in the following months and quarters.

Current levels of Chinese exports may take years to regain.

From a destination perspective, exports surged to G7 countries, especially the US, where shipments increased by 9.1% year-on-year in March compared to a 9.8% decrease in February. Exports to the UK rose by 16.3%, rebounding from a 13.9% decline, while shipments to the EU recovered to 10.3% following an 11.5% fall in February. Exports to Africa jumped by 37%, and shipments to ASEAN nations rose by 11.6%, following an 8.8% rise in February.

Kelvin Lam, senior China economist at Pantheon Macroeconomics, remarked:

Regarding trade policy, President Trump exempted certain electronics imports from tariffs late Friday, but clarified that this would be a temporary measure, with new sector-specific tariffs on semiconductors and consumer electronics forthcoming.

Importantly, this suspension does not apply to the existing 20% tariff linked to China’s involvement in the fentanyl trade. Nonetheless, this temporary relief for the electronics sector may provide some respite for Chinese exporters prior to the new tariffs being implemented. Greater clarity on the upcoming tariff rates is anticipated once the Section 232 Investigation concludes, with estimated rates ranging from 10% to 125%, as mentioned by US Commerce Secretary Howard Lutnick.

Source

www.theguardian.com